——— FINANCIAL POLICY FORUM ———

Derivatives Study Center

|

www.financialpolicy.org |

1660 L Street, NW,

Suite 1200

|

|

rdodd@financialpolicy.org |

Washington, D.C. 20036 |

Special Policy Brief 20

Derivatives

Use Surges by 30%

As Industry Grows More Concentrated

New

Data from the Bank for International Settlements

Randall Dodd

Director

Financial Policy Forum

December 21, 2004

The Bank for International Settlements (BIS) in Basel Switzerland recently released two reports that contained important new data on derivatives markets. One is the semi-annual “Regular OTC Derivatives Market Statistics” and the other is the triennial “Central Bank Survey of Foreign Exchange and Derivatives Market Activity.”

GROWTH IN MARKET SIZE

The amount of outstanding derivatives in global over-the-counter (OTC) markets grew at a 30% rate for the year ending June 30, 2004. The growth rate has average 28% since 1990.[1] That brought the global amount outstanding OTC derivatives to $220.1 trillion dollars.

The growth in OTC derivatives was across the board; strong increases were reported in foreign exchange, interest rate, equity and commodity based derivatives.

The gross market value of these OTC derivatives, which measures the present value of these outstanding contracts, was reduced over the year from $7.90 trillion to $6.40 trillion. After netting the gross market value between counterparties, the gross credit exposure in the OTC market fell from $1.75 trillion to $1.48 trillion.

Meanwhile, outstanding amounts or ‘open interest’ in exchange traded futures and options grew by 38% over the same period, with interest rate futures in particular growing by 42%. That brought the global amount of outstanding exchange traded futures and options to $49 trillion.

Taken together, the outstanding amount of OTC and exchange traded derivatives rose by mid-year 2004 to $269 trillion (that is, $269,050,100,000,000).

CREDIT DERIVATIVES

The BIS also reported that the notional amount of outstanding credit derivatives rose to $4.5 trillion – up from just $0.7 trillion in their last survey in 2001. The increase was weighted heavily in credit default swaps where contract terms have become standardized. Additional growth has come through the trading in credit derivative indices, synthetic collateral debt obligations (CDOs), and even the establishment of electronic trading platforms for credit derivatives.

WHITHER THE DOLLAR

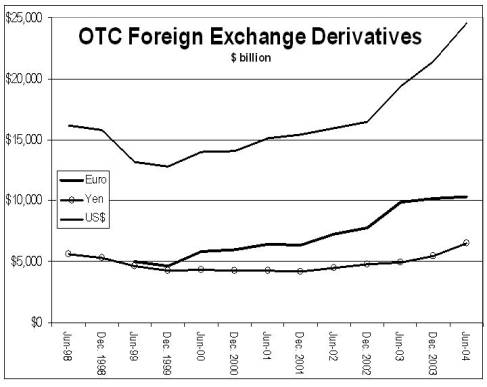

The data from the BIS also highlights some of the recent questions raised about the role of the US dollar in global financial markets. The amount of OTC foreign exchange derivatives denominated in US dollars has not diminished with the dollar’s value – a likely result of an increased interest in hedging. The data, as illustrated in Chart 1 below, shows a sharp increase in US dollar foreign exchange derivatives since the end of 2002 while that for Euro and Yen contracts has grown at a rapid but relatively slower pace.

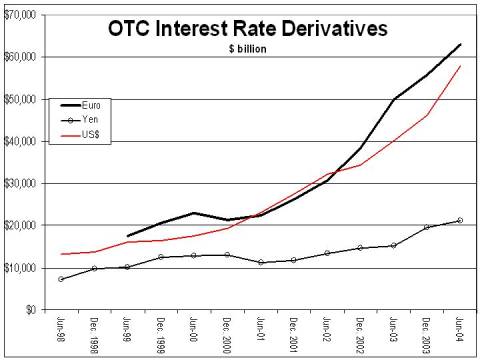

Growth in US dollar denominated single currency interest rate swaps – the most prominent type of OTC derivative contract – also shows a strong and continued interest in the US dollar. Chart 2 below shows that the growth in dollar interest rate swaps has continued apace with that of the Euro and they both have outpaced swaps denominated in Yen.

Chart 1

Chart 2

DEGREE OF MARKET COMPETITIVENESS

The triennial BIS report also contains the first of a new series of data by the BIS on the degree of market concentration in the derivatives industry. New and better data on these markets is always a welcome development. While the data from the December report are very interesting, more information on the methodology and the number of market participants is needed in order to make more sense of the figures. Until then, the following is a brief digest of what can be gleaned from the current report.

As the data from the Office of Comptroller of the Currency has shown, and it was discussed briefly in our Special Policy Brief 11, the share of derivatives in the US OTC market is very concentrated – amongst banks about half of all outstanding amounts is held by JP Morgan. The BIS report shows that concentration is even greater in other countries.

The BIS has put together some market share estimates, known as Herfindahl Indices, that measure the degree of market concentration. These are in turn broken down by country, currency and type of derivative.

The results show that while some markets are much more concentrated than others, that nearly all are growing more and more concentrated over time.

Comparing by currency of denomination, markets in US dollar and Euro denominated derivatives are less concentrated than those in Yen, Swiss Francs and Canadian dollars.

Comparing by country, equity derivatives in the US are much less concentrated than in Japan, Europe is a mixed picture (their options market is significantly more concentrated than in the US) and developing countries in Latin America and Asia are even more concentrated still.

Broken down by type, interest rate derivatives markets are less concentrated than foreign exchange markets, and those in turn are less concentrated than equity derivatives markets.

BACKGROUND ON DATA

The BIS is the oldest international financial institution. It was established in 1930 to help manage the financing of the reparation payments, which were mandated by the Treaty of Versailles, from Germany to the Allies following the end of the first World War.

After the second World War, with the reparations payments no longer an issue, the organization focused on implementing and supporting the international fixed exchange rate system known as Bretton Woods. Starting in the 1970s, the focus shifted to managing international capital flows and the developing country debt crises that followed the oil price shocks in the 1970s. The BIS strengthened its regulatory role by establishing international capital standards, known as the Basel Capital Accord, in 1988. Those capital requirements are currently being revised under the rubric of Basel II.

As part of its ongoing regulatory role, the BIS collects data on cross-border credit flows, foreign exchange trading and derivatives market activity.

SOURCE

The original BIS data is available at:

http://www.bis.org/publ/index.htm

Information from these data releases has been, in part, entered into spreadsheets available on the Financial Policy Forum website:

http://www.financialpolicy.org/dscdata.htm

THIS REPORT IS ALSO AVAILABLE AT

www.financialpolicy.org/dscbriefs.htm